Top 21 Best Billing Software For Tradesmen & Contractors

Are you still billing customers manually? Take your business to the next level with easier, more accurate accounting processes that reduce errors and slash time spent chasing payments

Whether you’re a lawn care business, plumbing company, or general contractor, one of the more unglamorous business processes you have to conquer is billing.

Taking the money to the bank for your hard-earned work feels great. Managing the books, tracking and chasing payments, considering taxes, and issuing invoices…not so much.

The good news is there are many billing software options available to simplify this. And with plenty of free accounting software options, you don’t have to overspend or be tech-savvy to use them.

Some of the most effective solutions are affordable and easy to use – with most invoice tracking software paying for itself after just 6-18 months.

The sooner you implement an automated billing solution, the easier it will be for you to streamline how you collect and track payments for your services. Of course, you might already have a solution in place, but if that solution is a notebook or an Excel spreadsheet, you may want to reconsider your approach.

Excel has a time and a place, but you might find you’ve been doing things the hard way.

Upgrading your existing software may sound like a hassle, but it can give you new insights and tools that outdated programs don’t offer.

The latest billing software can help you track payments, but it can also help you:

- streamline paperwork

- reach out to customers

- schedule reminders

- paint an accurate picture of your cash flow

The key is to choose the software best suited for your business and accounting needs, taking into account features, options, and licensing terms. It’s worth noting there are many programs designed for enterprise companies that are overkill for trade businesses – so we’ll show you what to look for and what to avoid.

If you’re ready to unlock more free time for your business, check out our review of the top 21 best billing software options for local trades and contractors.

What are the benefits of using billing software?

Not sold on paying for software to manage your payments?

Invoicing software can help with more than just sending out bills.

Having a clear idea of software capabilities can help you narrow down your search as you explore what specific programs have to offer. Consider the positive effect these factors can have on your business if you roll out accounting software (or upgrade your existing platform).

Improved organization

Growing a business – whether bringing on new accounts or expanding recurring client projects – presents challenges in scalability. Small business invoice software can make it easy to see exactly how many current, open customers you have and how each affects your bottom line.

You can track which accounts are ready to bill and who hasn’t paid yet, helping you better understand your cash flow. Expecting funds and actually having them in the bank are two very different things.

Accounts payable software can also save you and your office staff time. In fact, automated invoicing and payments save businesses nearly one hour each day. The software can also send follow-up reminders to past due accounts, issue automated invoices when you complete a job and tie into banking and tax software.

Advanced insights

Running reports might not sound exciting, but they can be a great way to understand how your business is performing.

With invoicing software, you can track more than just payments. Which accounts or customers pay on time or return for more business? Identify these and then reach out to grow your business with these high-quality clients.

You can also report on cash flow and projected income to make fine-tuned business decisions. Your schedule is packed, but do you have the capital to bring on more staff? Considering raising rates or lowering them to remain competitive? Accounting software can help you make the right decisions based on hard numbers.

Extra flexibility

Some invoicing software supports credit card or ACH transfers for payment processing. These options can give your customer more flexibility and help you collect payments more quickly.

In some cases, you can even collect payment on the spot at the completion of a job. They can also be more reliable than waiting for a check to clear or for someone to hand over cash. Just watch out for fees – some programs charge extra or have processing charges.

Extra funds

Money doesn’t grow on trees, but it can hide untapped if you aren’t accounting for missing customer payments or interest.

Centralizing all payments, expected income, fees, and taxes in a single system can prevent negative cash flow management that slows business growth and might be preventable if you have accurate records to set clear expectations.

20 best billing software options [2023]

Sorting through billing software can be overwhelming, especially if you consider yourself less-than-knowledgeable about accounting or tech.

Exploring our top-21 list can help you narrow down your choices and focus your software search. The following options are ideal for small businesses, offer different feature sets, and provide flexibility for reporting, invoicing, and monitoring cash flow.

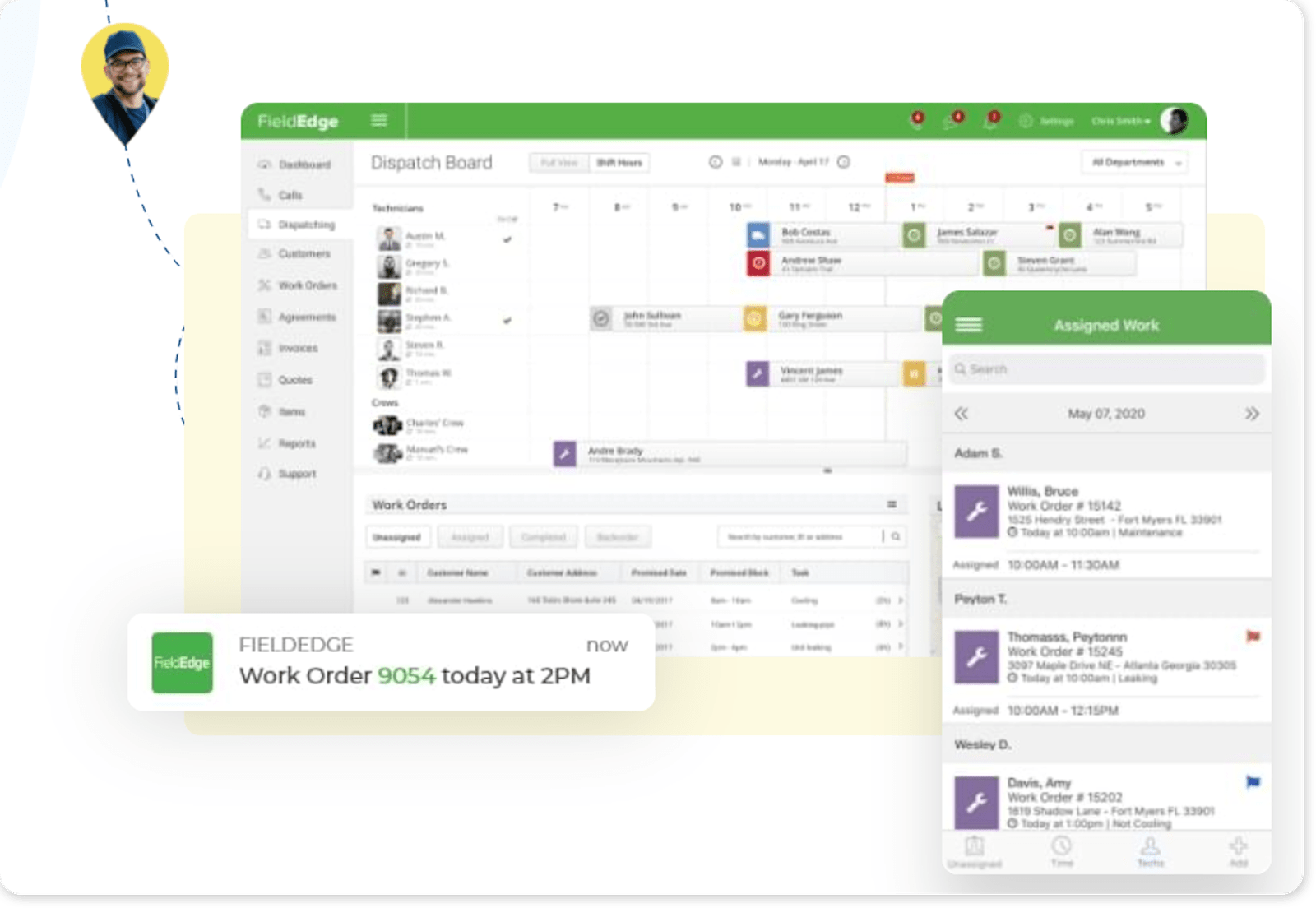

#1- Field Edge

We’re kicking off the list with a solution designed specifically for trades and contractors.

FieldEdge is designed for businesses in industries including plumbing, electrical, locksmiths, HVAC, and even appliance repair.

You can integrate this software with QuickBooks or use it to manage payment for services. This software makes sending itemized invoices easy and that the included support is fantastic – making this one of the best invoice apps for tradesmen.

Top Features

- Built-in payment processing

- Paperless invoices

- Mobile card readers

Trial and Pricing

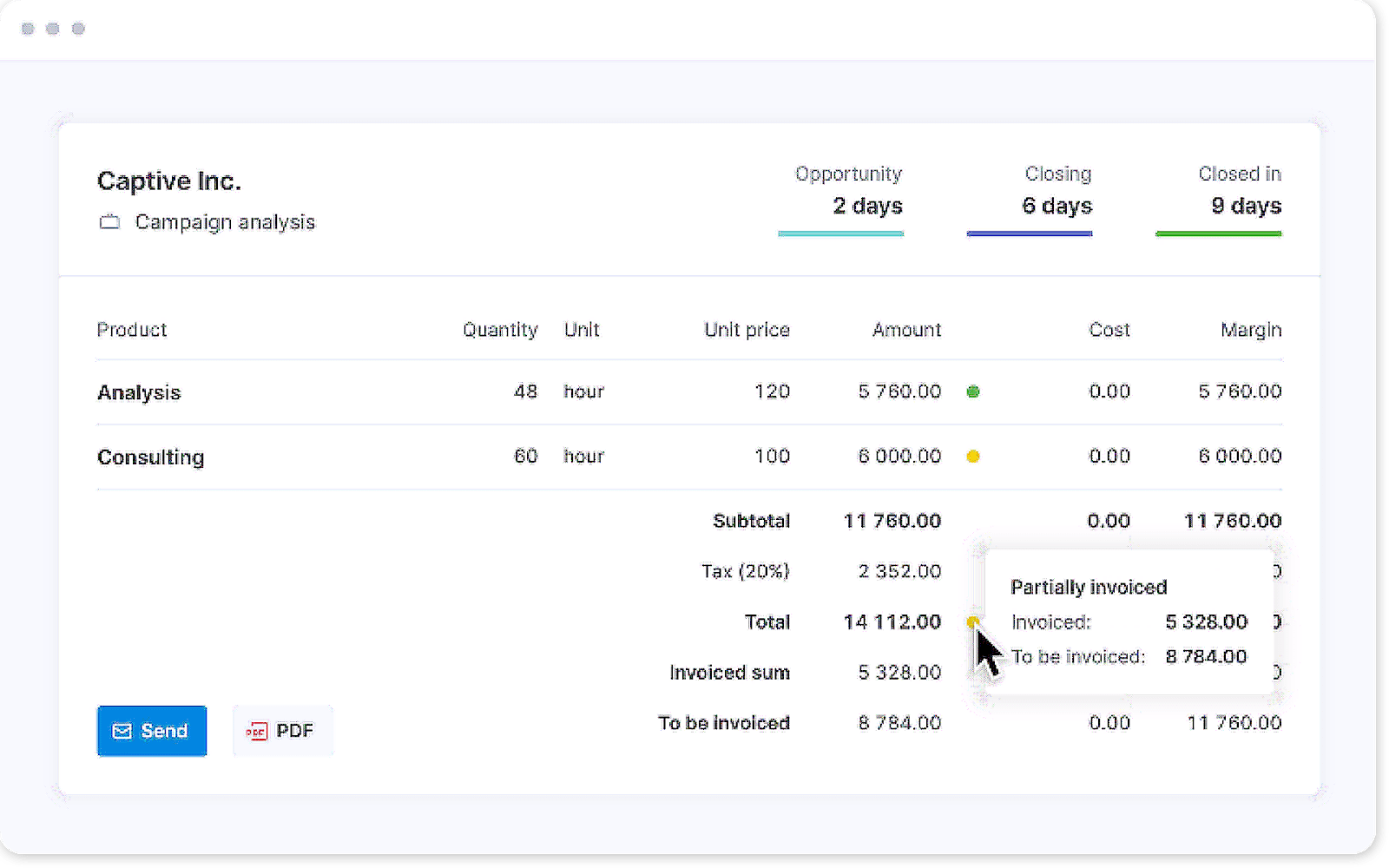

#2 – Scoro

Scoro is an easy-to-use, cloud-based work management platform. With nothing to install, users can get up and running quickly.

This software facilitates quick billing with minimal software know-how to get started. As a result, Scoro may help your company boost revenue. One negative that stands out: some features (such as partial invoicing and late invoice reminders) cost extra, and the fees can add up. If you’re looking for one of the best invoicing apps for contractors, Scoro is right up there.

Top Features

- Built-in reports allow for easy order, purchase, and invoice oversight

- Automated billing and recurring invoices

- Supports partial invoicing and prepayment options

Trial and Pricing

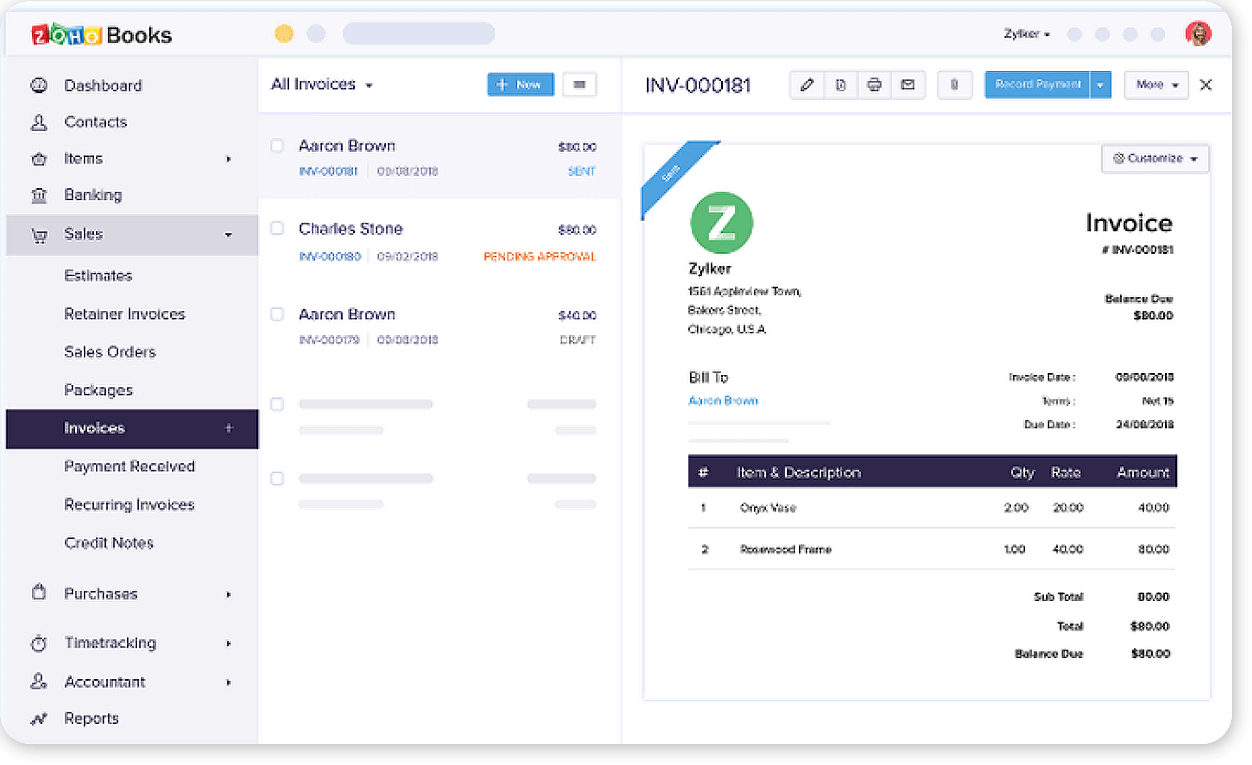

#3 – Zoho Books

Zoho is one of the premier brands when it comes to affordable small business software. Their accounting software, Books, mirrors their CRM systems with easy online tools.

This software is straightforward, easy to use, and compatible with other Zoho tools but the look and feel may be basic depending on your needs. For simple bookkeeping, Zoho Books is an intuitive option, however, some experience in accounting or other payment systems will make the experience easier.

Support is included and ranges from videos, FAQs, quick guides, and ad-hoc content to email and phone live support.

Top Features

- Cover the entire billing lifecycle

- Manage everything from receivables to reporting

- Use sales tax compliance options for both revenue and vendor payments

Trial and Pricing

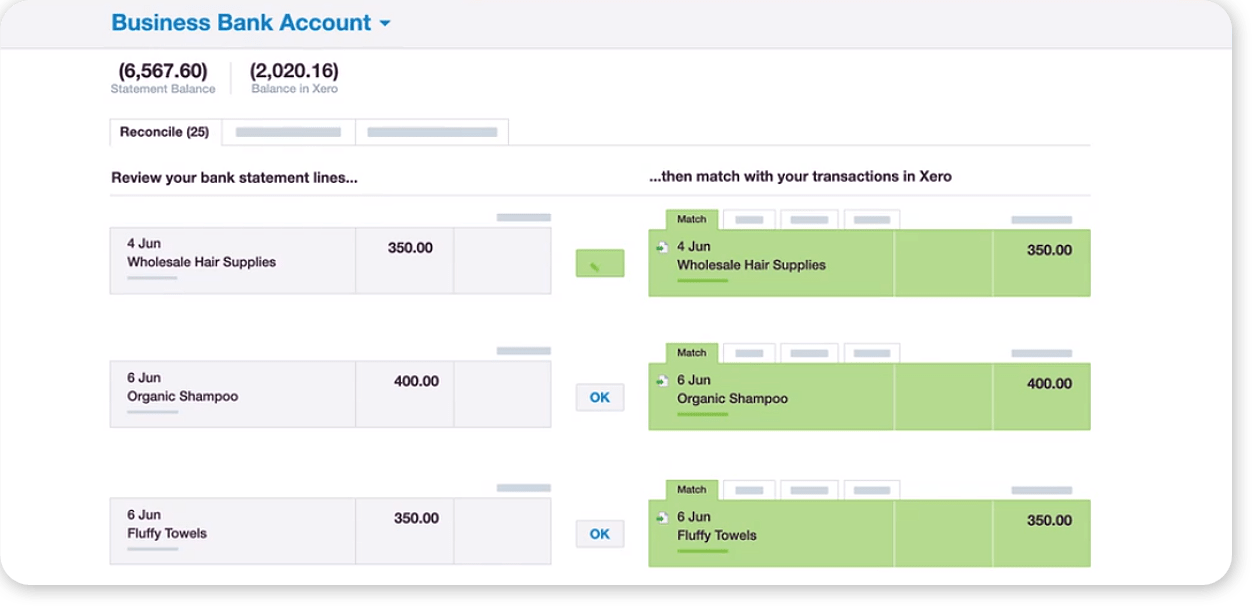

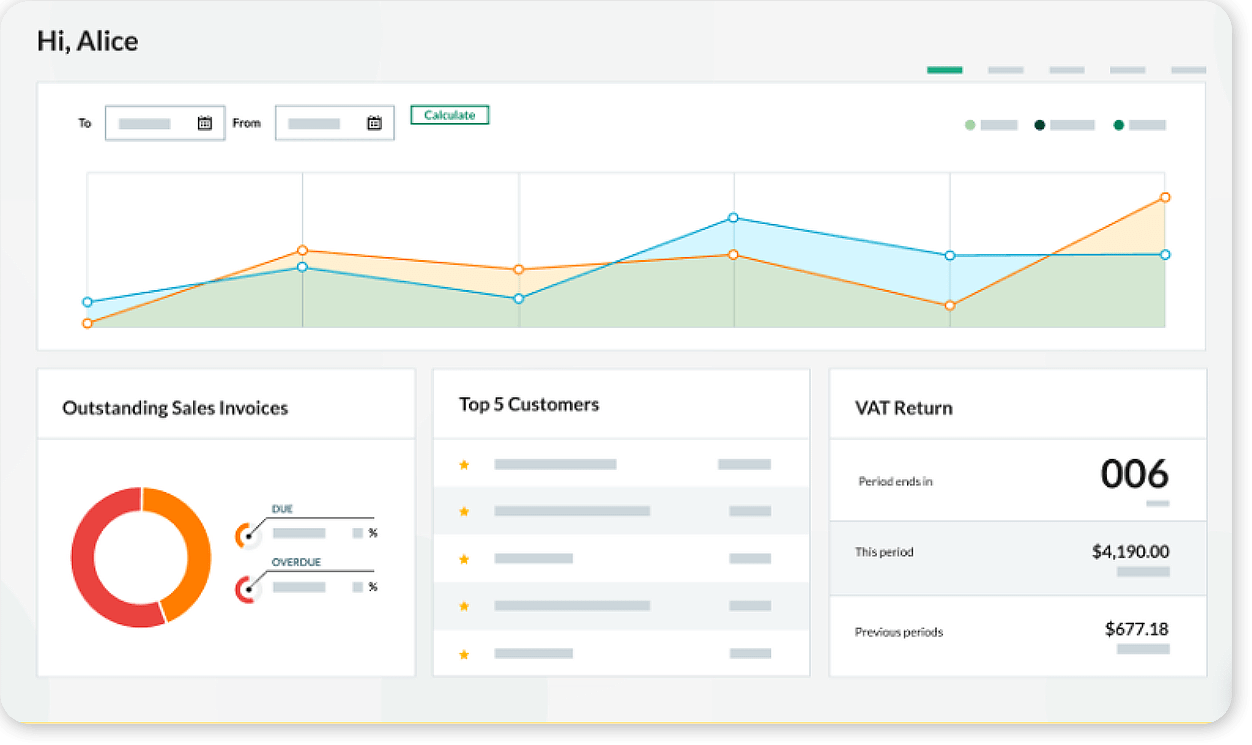

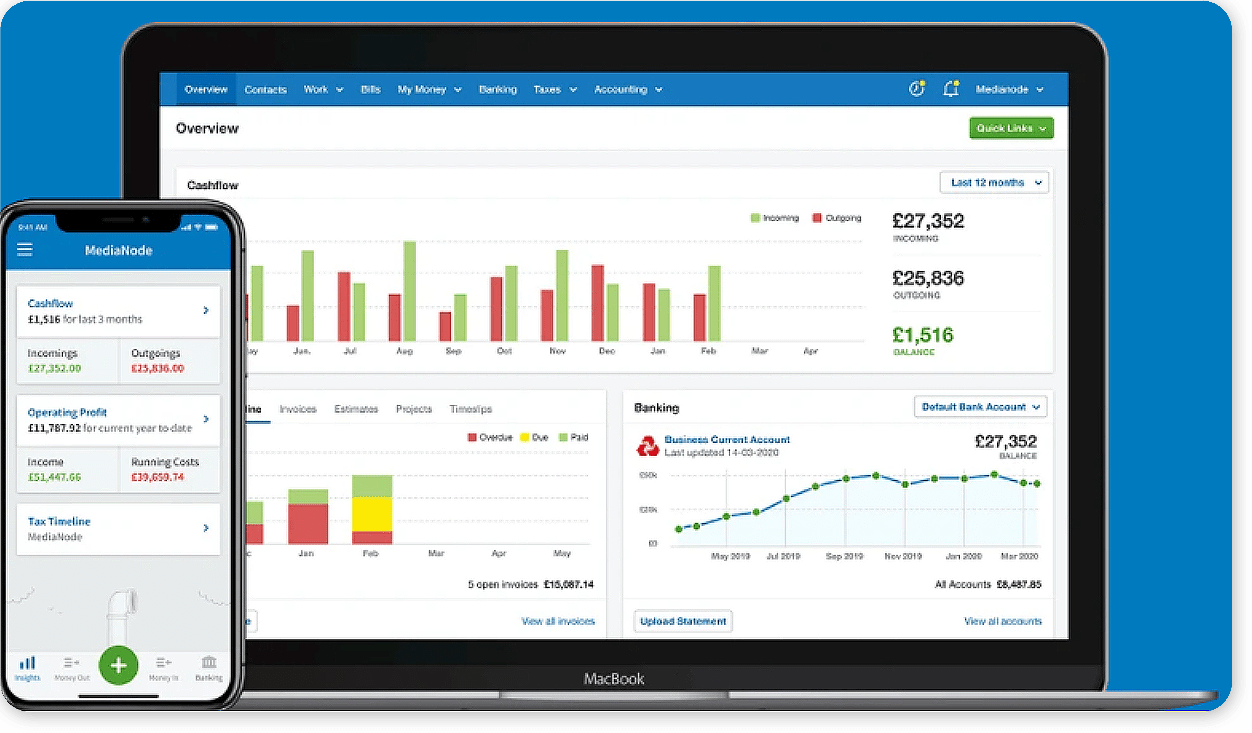

#4 – Xero

From bank connections to payroll, Xero offers a comprehensive feature set that simplifies all things payment.

With over 15 years of providing accounting software solutions, Xero has a strong reputation in the billing software space. It’s easy to see why with straightforward bank integration and online payment support for platforms like PayPal and Stripe.

Top Features

- Supports essential workflows around billing, invoicing, orders, and tracking

- Use quick, easy ways to monitor cash flow

- Monitoring financials specific to your small business needs

Trial and Pricing

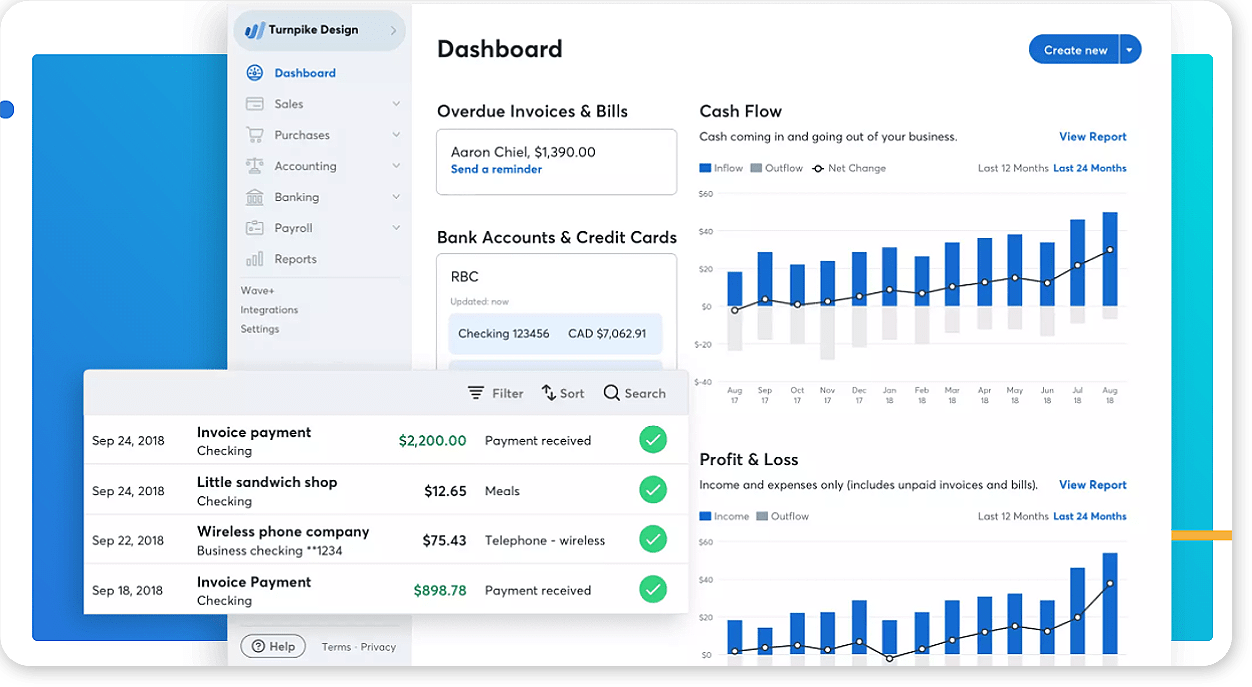

#5 – Wave

Worried about tax season?

Wave organizes small business expenses, income, and invoicing so that reporting and audits are simple. Mobile apps make receipt scanning quick – no more searching your pockets or sorting through files.

While you’ll save on software costs, you might experience an additional headache or two if you run into technical difficulties. The small business feature sets available are extremely strong, and many come with a free price tag to help keep costs down.

That said, support seems to be lacking. Unless you pay for add-on services, you’ll have to email in your questions and wait for responses that may take days.

Top Features

- Many unlimited features such as bank and credit card connections

- Income and expense tracking as well as customized invoices

- No extra fees for access compared to competitors who charge extra or require pricier tiers

Trial and Pricing

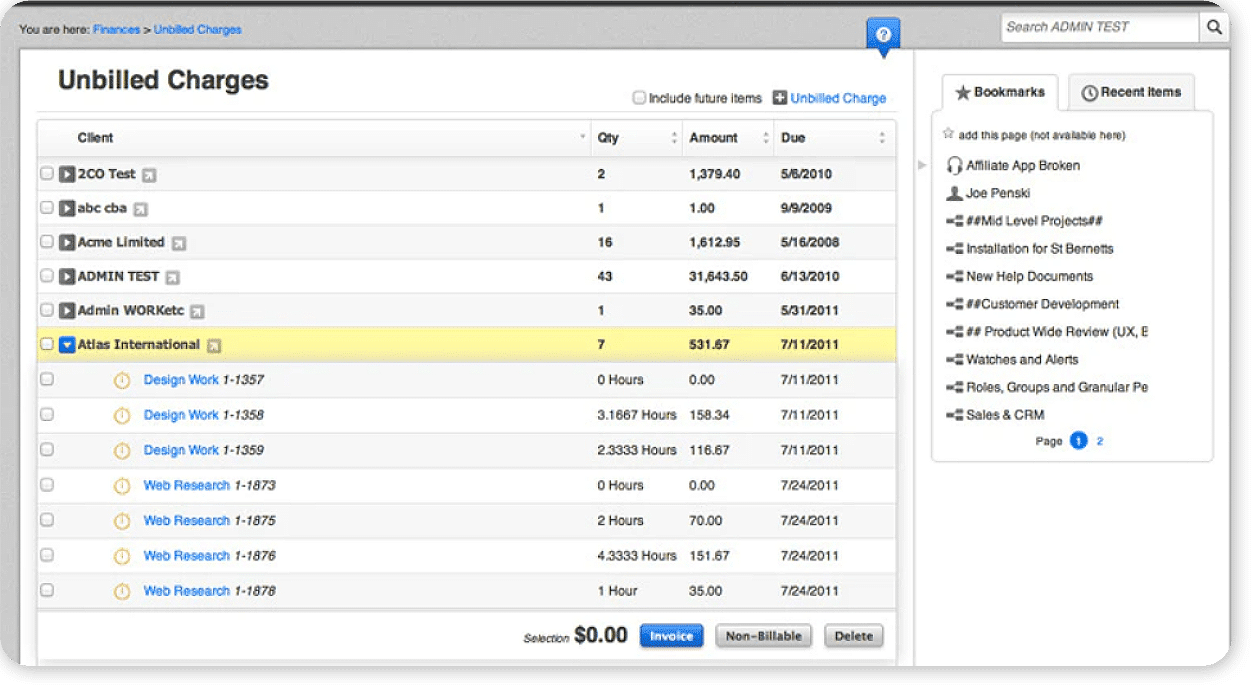

#6 – Work[etc]

Don’t have a CRM or software to manage your customer records?

Work[etc] offers an all-in-one solution for customer management that covers accounting, too. This option is a strong all-in-one product, bringing together project management and invoicing. The included support also gets high marks from us, although there is a steep price to access more premium levels of support.

Top Features

- Manage client contact information as well as projects and jobs

- Seamlessly track expenses, invoices, and overdue reminders

- Use their mobile app to log time and expenses on the go

Trial and Pricing

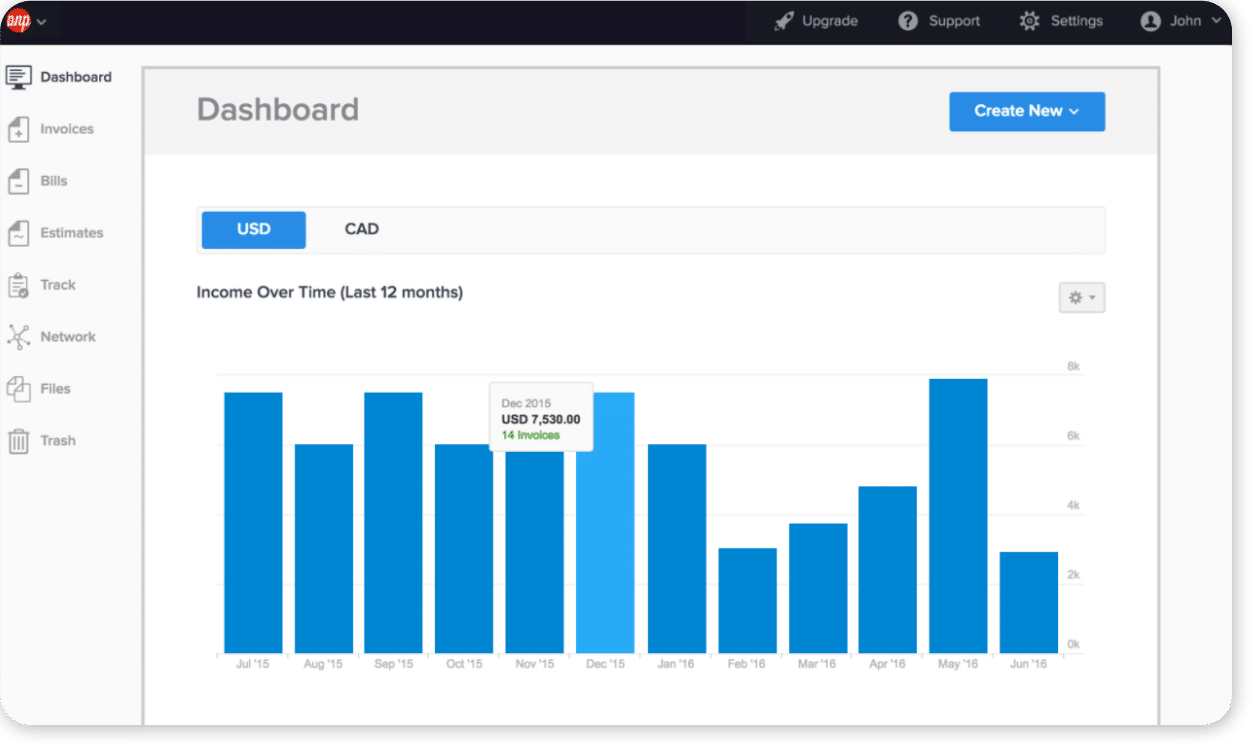

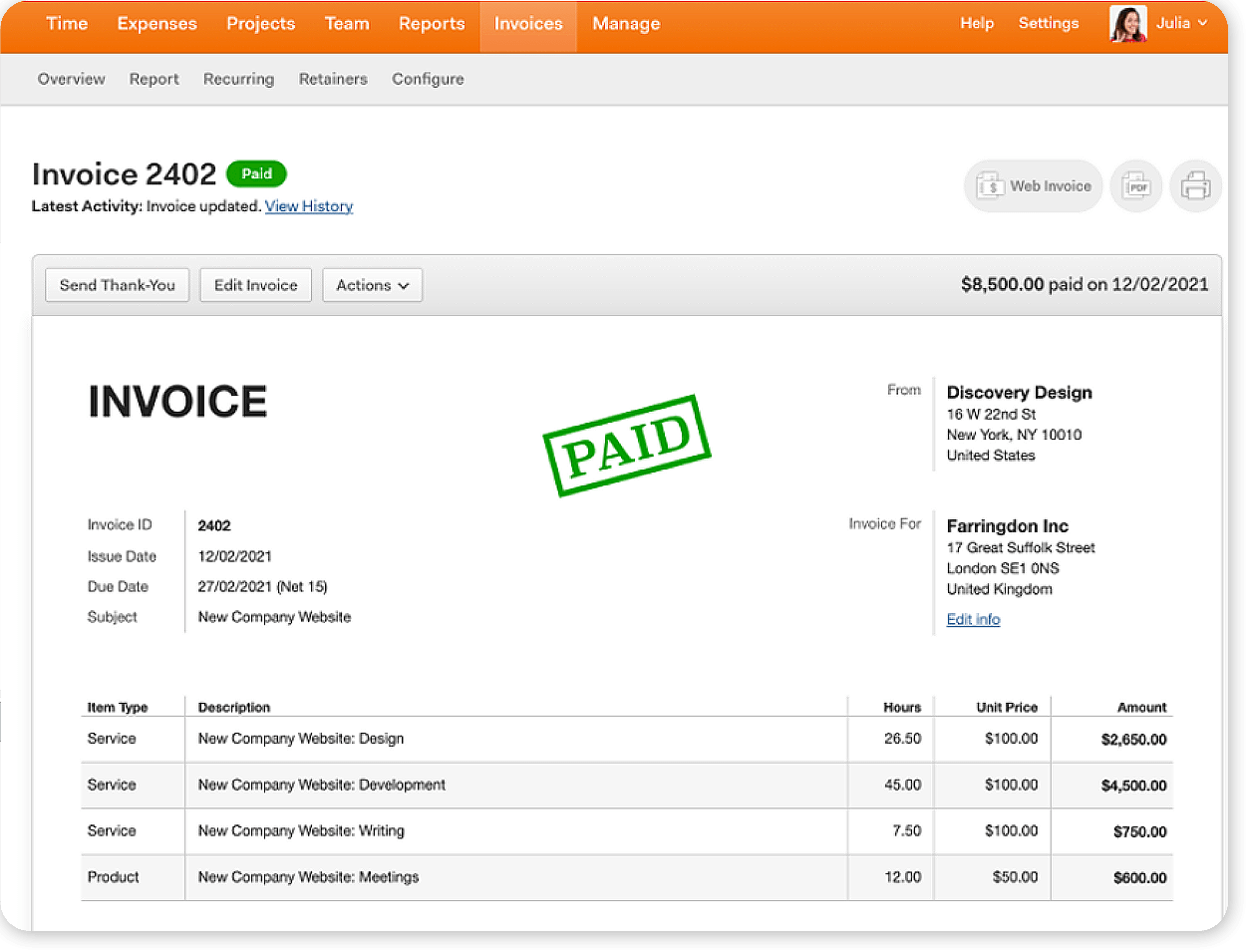

#7 – Harvest

Harvest stands out as an invoicing specialist.

If you already have accounting software like QuickBooks for bank integrations and tax management, Harvest can streamline your billing processes. Harvest is not as robust as other solutions, focusing mainly on time tracking and invoicing, though this is on the list of the best invoicing software for contractors.

Top Features

- Create and automate invoices via email

- Create reminders to encourage timely payment

- Include offering online payment options for recurring payments

Trial and Pricing

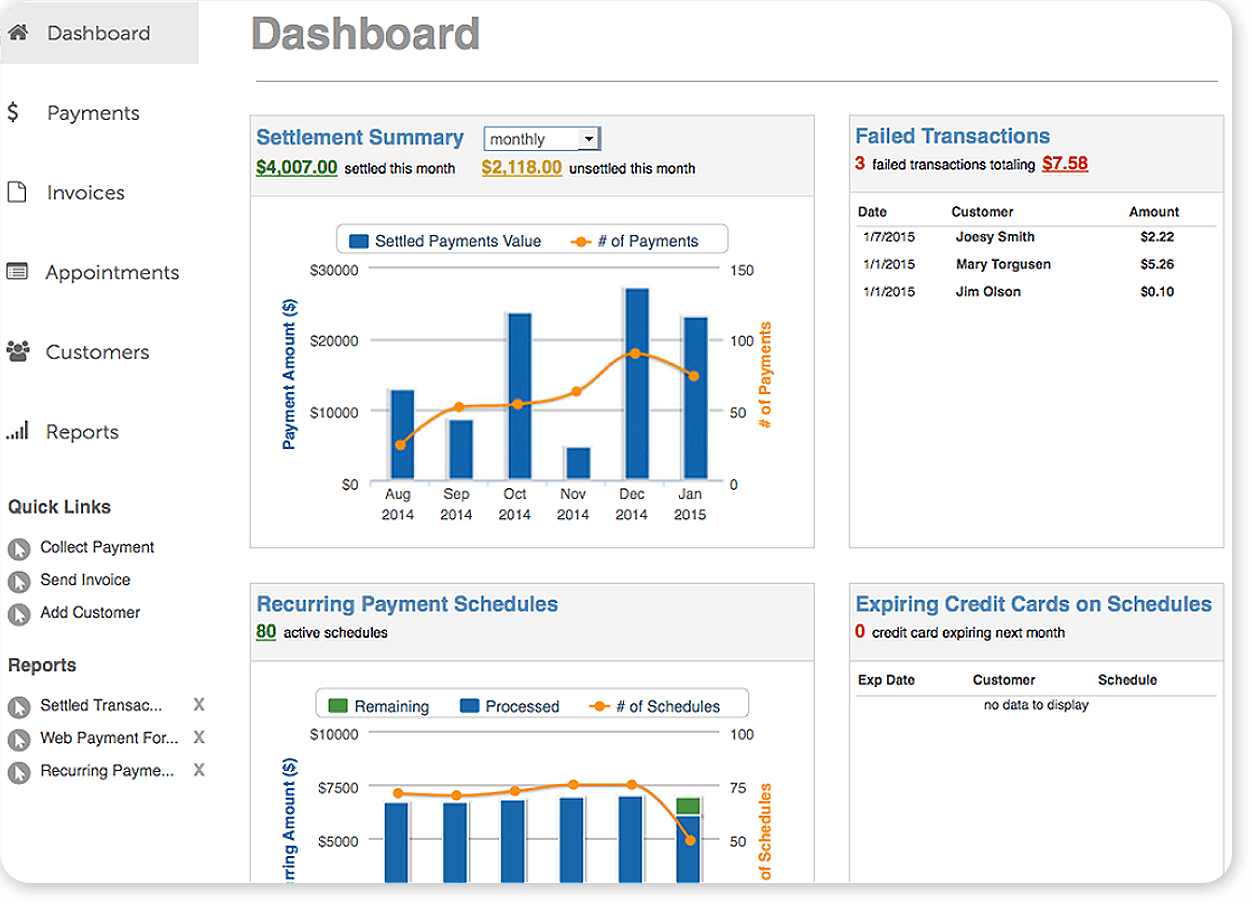

#8 – PaySimple

Invoicing with a focus on flexible payment options? PaySimple is designed to give your customers a range of ways to pay you on time and online.

Every transaction is logged for easy reporting, and invoice options include reminders and late fee management.

Top Features

- Create an online storefront to sell services or schedule appointments

- Use their credit card processing for consistent cash flow

- Leverage options for recurring and mobile payments

Trial and Pricing

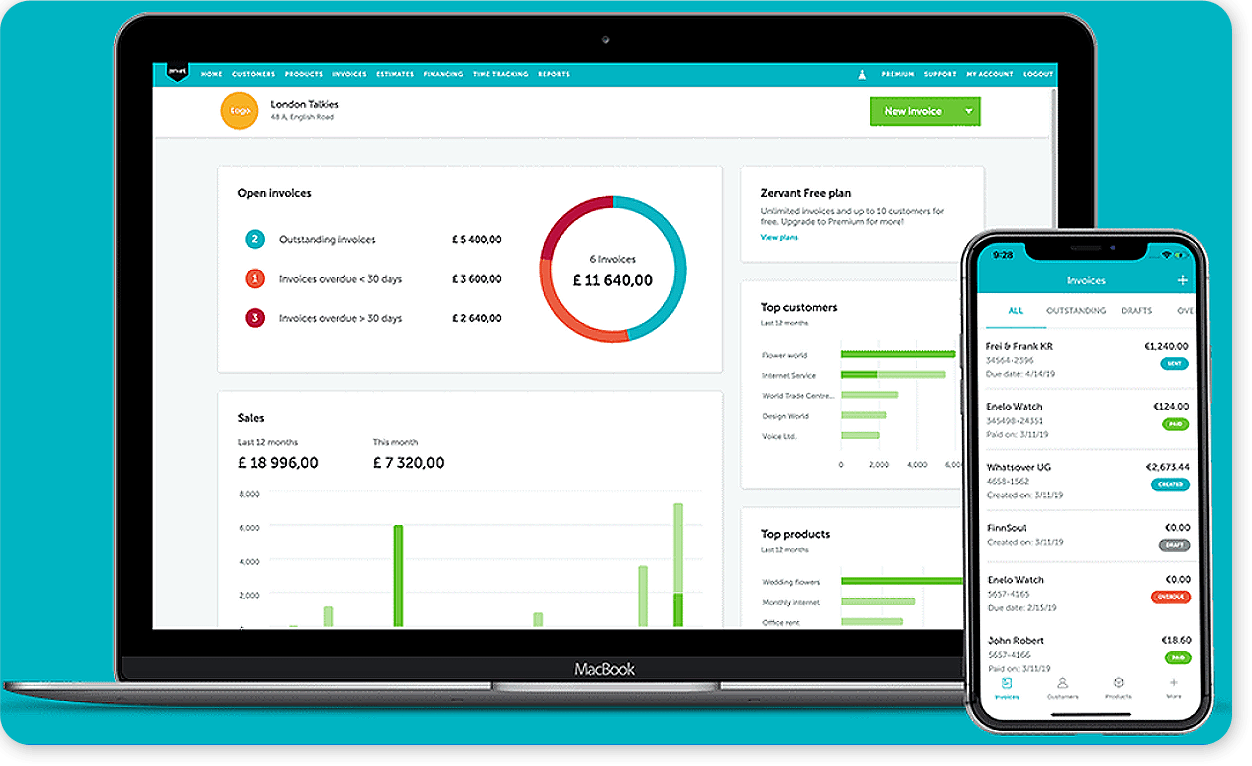

#9 – Zervant

Zervant specializes first and foremost in invoicing.

Down payments, scheduled payments, and even custom arrangements are supported so you can start jobs with confidence that you’ll be paid. All features help small businesses simplify payments so they can focus on their other priorities.

Zervant’s small-business focus means there’s value to be found across customer support, ease of use, and scalability for up-and-coming businesses.

Top Features

- Create a custom invoice and email templates

- Use easy-to-read status dashboards

Trial and Pricing

#10 – Sage

A name known for its enterprise solutions, Sage now offers small-business options to help with core accounting tasks. With a CRM at its core, this option excels at automation.

Sage includes Apple and Android mobile app access and is a software that’s easy to use for non-accountants looking to track their billing and payments. One negative to keep in mind, you may encounter difficulty when migrating from an existing system over to the Sage accounting platform.

Top Features

- Automate invoices, email reminders, quotes, expense tracking, and even bank reconciliation

- Review dashboards and insights easily, showing real-time cash flow and expenses.

- Focuses on automation and templates so you can reduce admin time and increase productivity

Trial and Pricing

#11 – Hiveage

Especially designed for small businesses, Hiveage puts the tools you need front and center to make invoicing less of a hassle. From estimates to invoices, Hiveage keeps every expected expense and payment detail in one place.

The software also has an impressive 4.9 out of 5-star rating on Capterra. Hiveage is easy to set up as well as present branded, professional invoices. Expect plenty of customization options for your emails as you send out payment requests and reminders.

Top Features

- Set up automatic, manual, or recurring payments with customer reminders and receipts

- Incorporate your brand, create templates, and access account details online and on your phone

Trial and Pricing

#12 – FreeAgent

Want a professional invoice without wasting time on design? FreeAgent offers a gallery of invoice templates you can customize to fit your brand quickly and easily.

This is another software that is easy to use, even if you’re transitioning from Excel spreadsheets. This platform is simple for new business owners to learn, offering an intuitive experience for non-technical users. As a side note, FreeAgent won the Small Business Accounting Software of the Year award in 2020 from Accounting Excellence – so expect a powerful billing tool.

Top Features

- Send invoices manually or schedule them as needed.

- Set up price lists for streamlined reporting and invoice inclusions

- Integrate with Stripe, GoCardless, and PayPal

Trial and Pricing

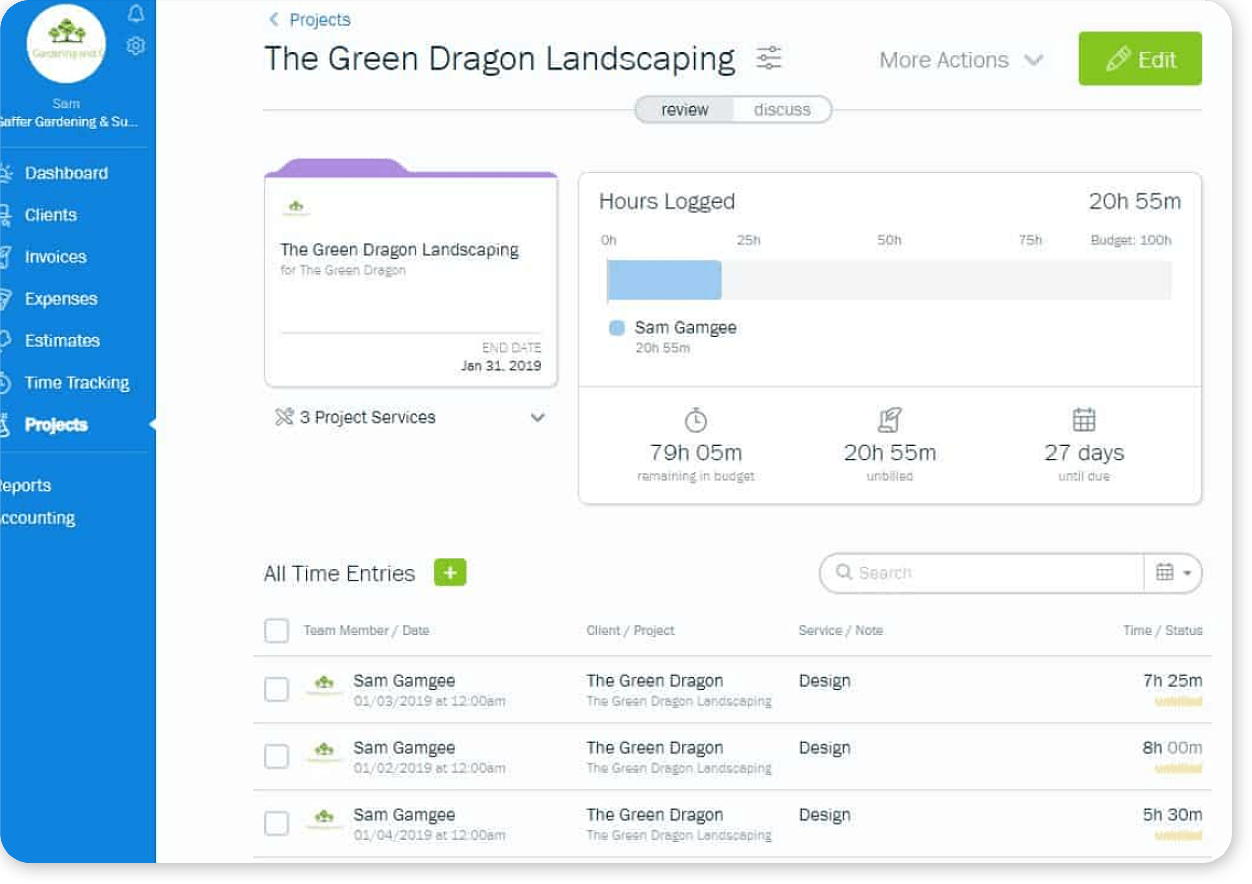

#13 – FreshBooks

With FreshBooks, you can choose software versions that match your business structure. Whether you are a solo entrepreneur, oversee employees, or work with contractors, FreshBooks offers accounting software that will help you meet requirements at tax time.

The features are designed for small businesses, including recurring invoicing and project management.

Top Features

- Use built-in invoicing, expenses, payments, and reporting designed for professional use

- Integrate with other systems, including Gmail and MailChimp to improve customer communication

Trial and Pricing

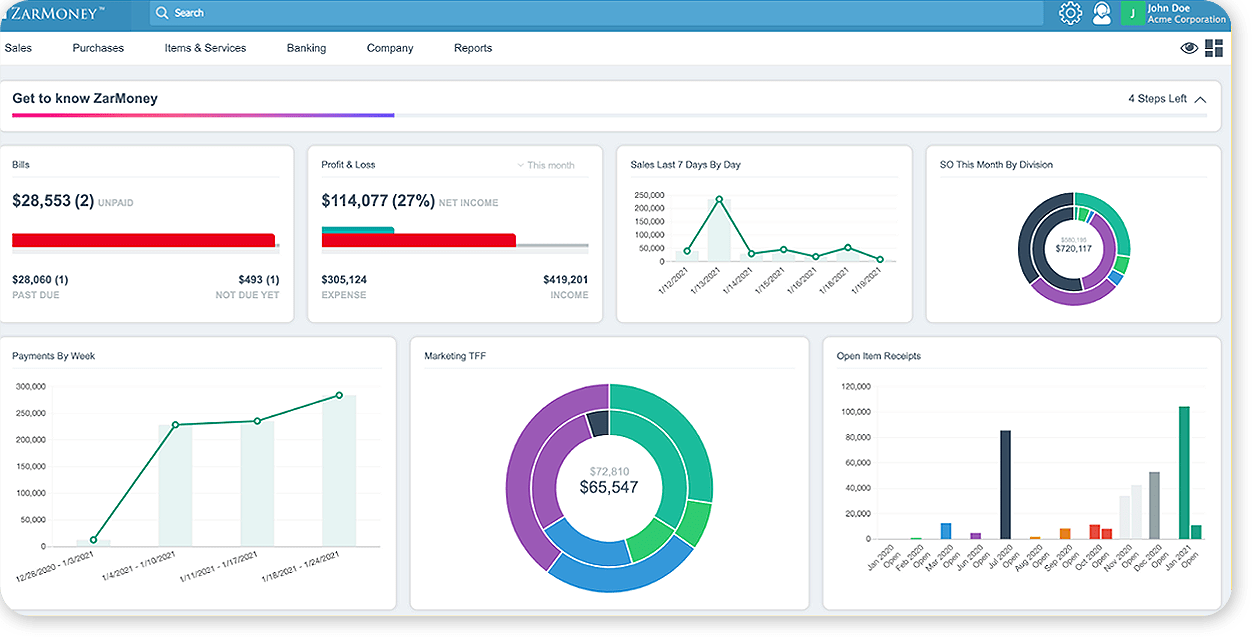

#14 – ZarMoney

From sales orders to fund transfers, ZarMoney offers advanced accounting options geared toward businesses looking for a one-stop solution.

All accounts include U.S.-based customer service and unlimited transactions, so you can grow your business with accurate cash flow figures.

You’ll love how responsive the support teams are and how fast it is to get started, even with custom branding and bank integration set up.

Top Features

- Manage payments and billing across client accounts

- Hooking into banks to manage deposits or report on taxes

Trial and Pricing

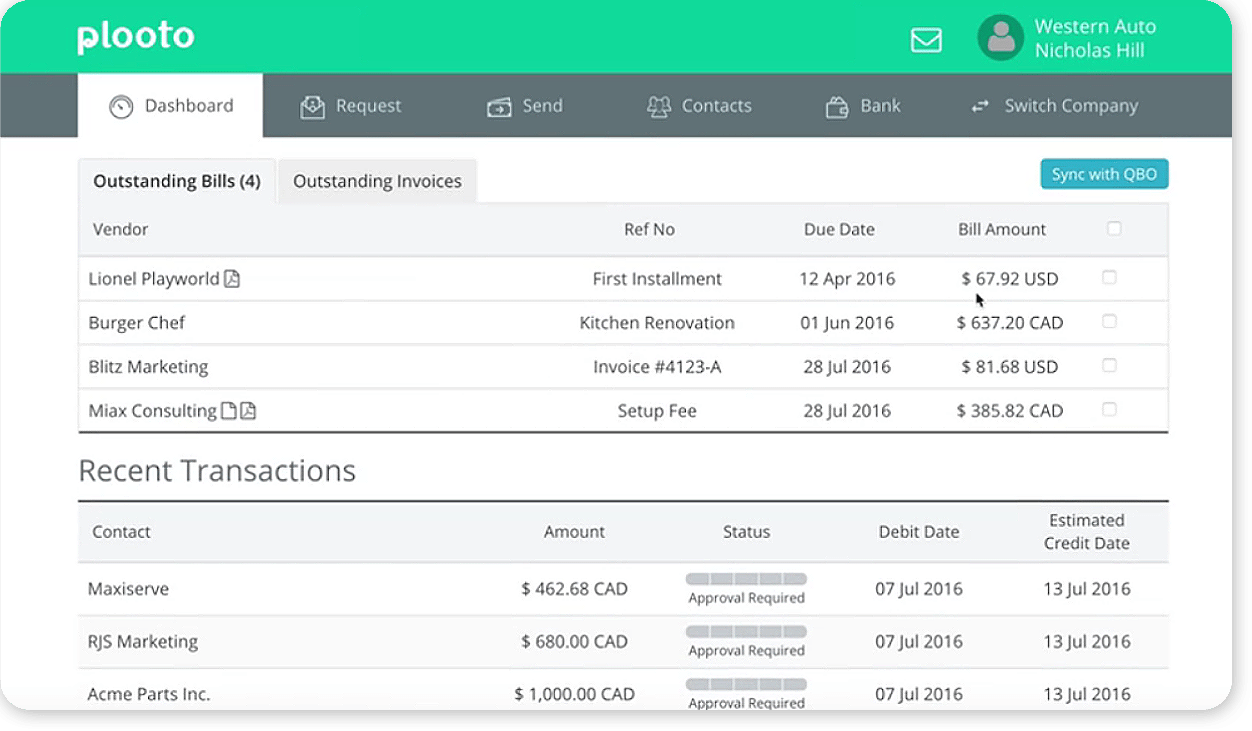

#15 – Plooto

Core to its mission, Plooto prioritized making cash-flow insights easy and actionable for small business owners.

If you offer regular services like lawn care or pest control, you can set up a simple workflow that sends customers emails, payment reminders, receipts, and more. It’s worth noting that high-volume payments can push up costs quickly.

Top Features

- Monitor inbound payments, outbound deposits, and everything in between

- Manage money and related communications in one platform

Trial and Pricing

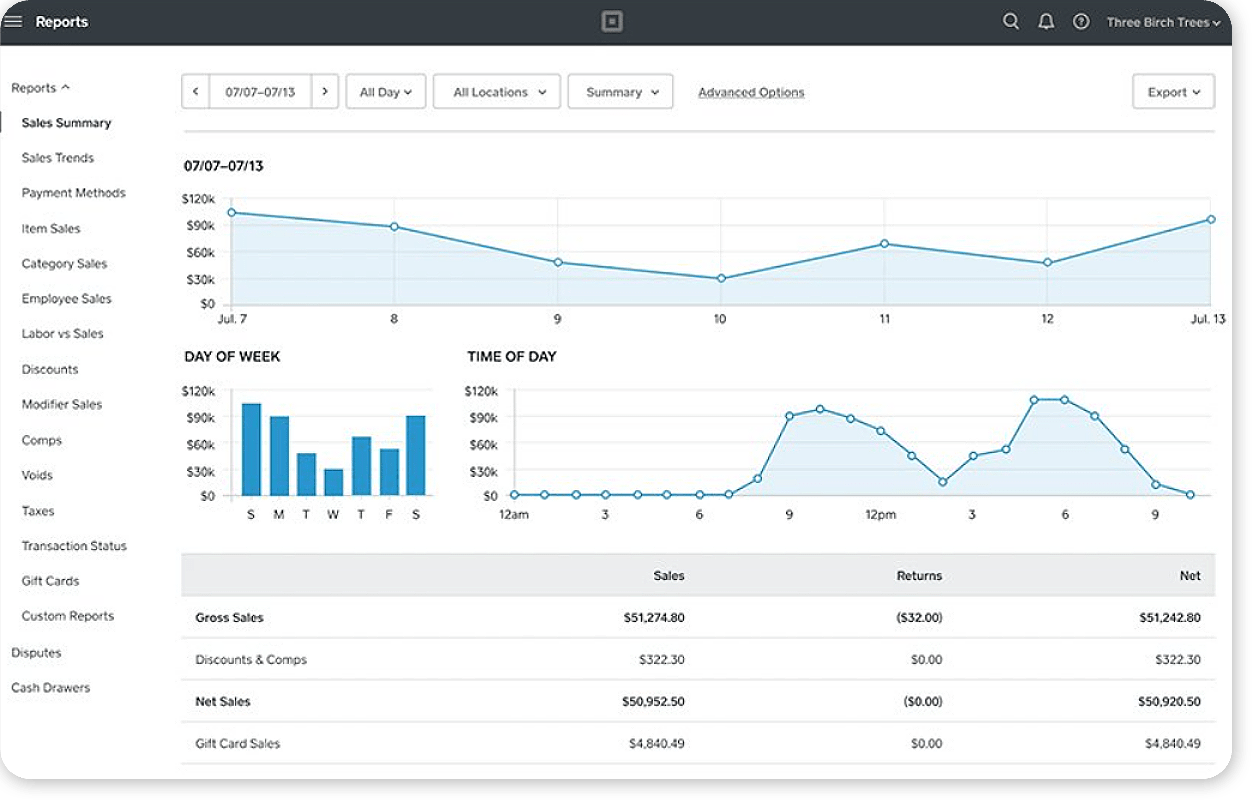

#16 – Squareup Invoices

Chances are that you’ve seen Squareup when shopping locally or working with other vendors. Known for its mobile payment technology, Square makes it easy for small businesses to collect credit card payments.

Expect an easy-to-use billing software, though certain elements, such as invoice layouts, are harder to apply or offer limited customization. If you rely on credit card payments, explore all available options since users also mention that Square’s transaction fees can be high.

Top Features

- Manage invoices, payment reminders, and recurring payments tied to credit cards

- Collect payment at the end of a job without manual entry

- Manage and automate receipts without slow down workflows

Trial and Pricing

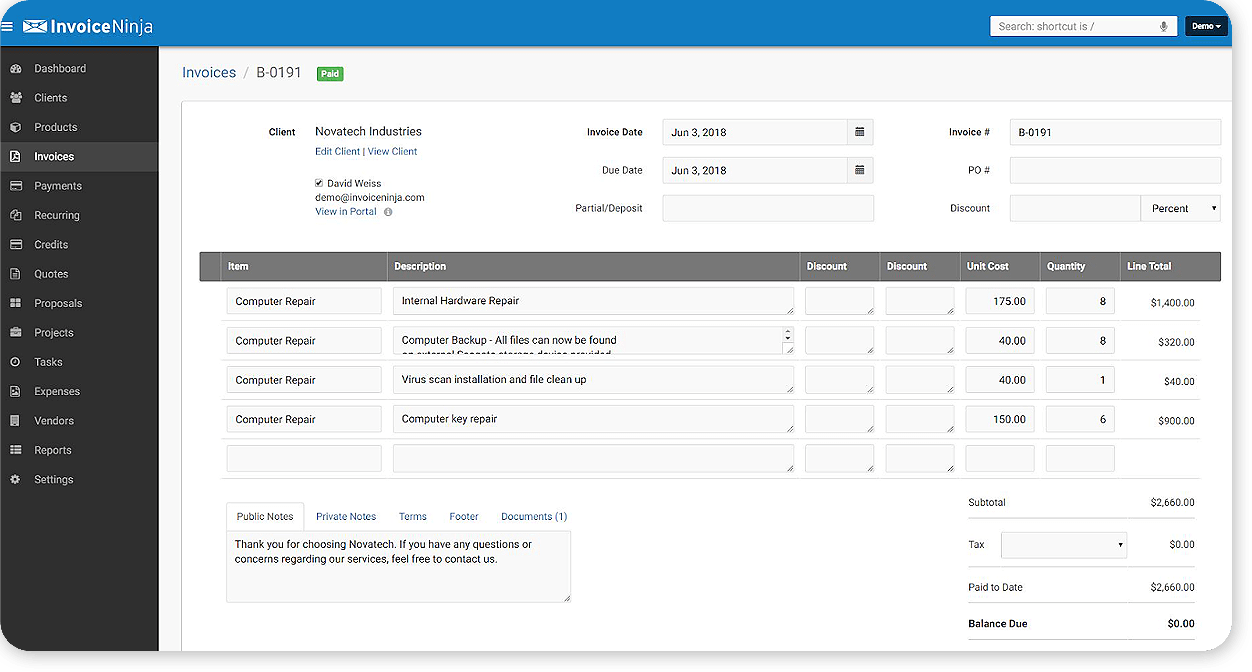

#17 – Invoice Ninja

Another powerful option for project management and billing combined, Invoice Ninja brings together quotes, proposals, and planning with real-time invoicing and support for online and recurring payments.

Invoice Ninja makes connecting payment options easy and customization options are extensive.

Top Features

- See and report on expenses and sales activities

- Assess which conversations are bringing in business

- Connect to over 40 payment gateways including Stripe and PayPal

Trial and Pricing

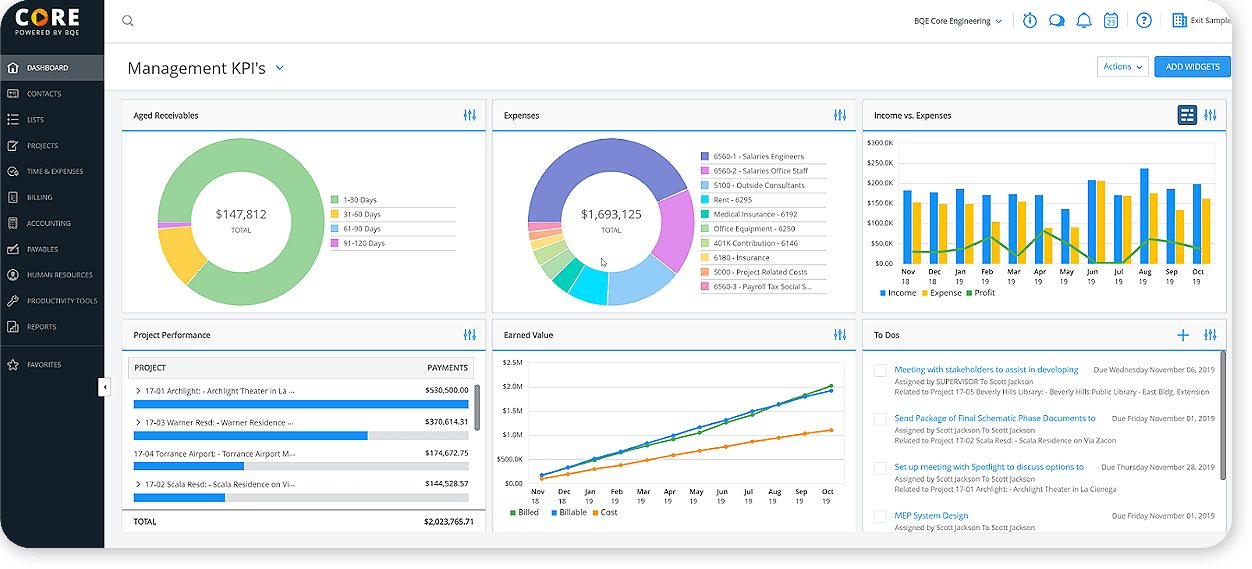

#18 – BQE Core

Looking for more advanced online accounting software? BQE Core offers full general ledger views, engagement-based accounting, and profit & loss reports. End users tend to be accounting professionals, and the software is actually partnered with several leading professional organizations.

Top Features

- Designed for accounting gurus and bookkeeping experts

- See a clear view of your operating expenses and cash flow

- Cut down on wasted spending and redundant costs

Trial and Pricing

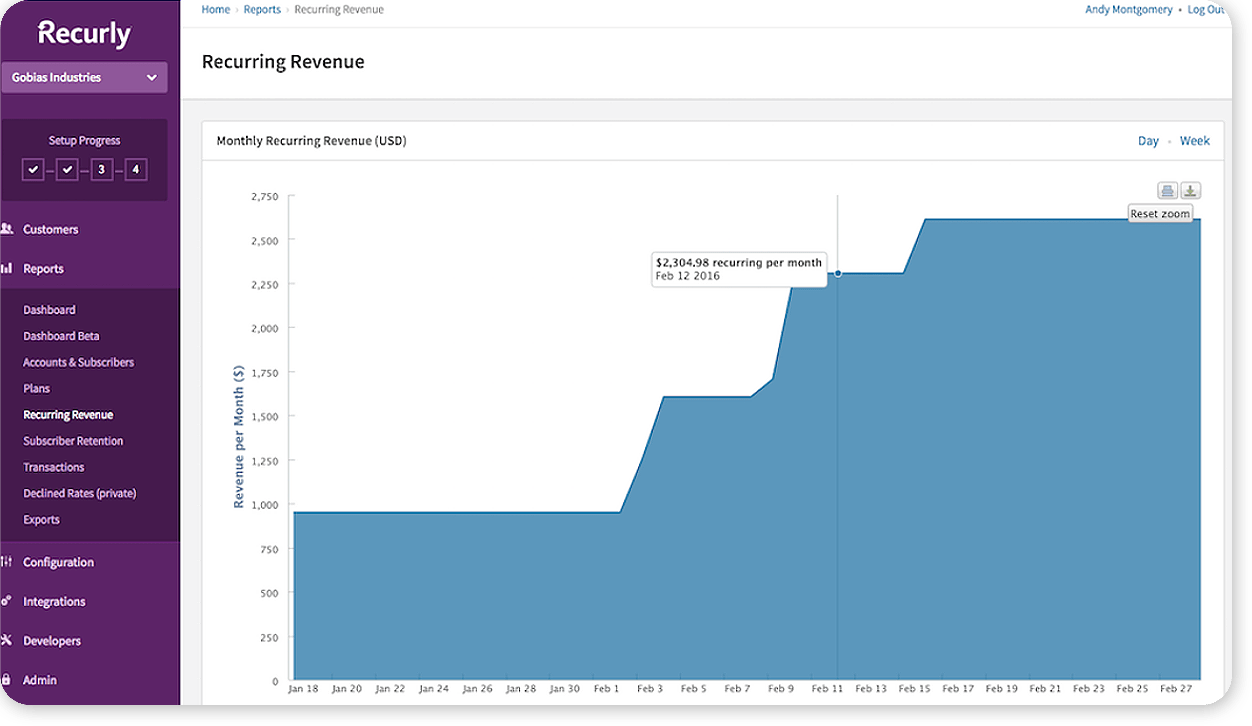

#19 – Recurly

Recurly shines for businesses that work off of a subscription or recurring payment model. You can set up repeat transactions once and let the system manage everything from processing to receipts for you. You can also maintain copies of invoices.

Recurly allows you to send notifications before accounts automatically renew so you can be transparent about your billing practices.

Top Features

- Create hosted payment pages, so customers can pay online in a secure form

- Integrate with other accounting software to support tax audit needs

Trial and Pricing

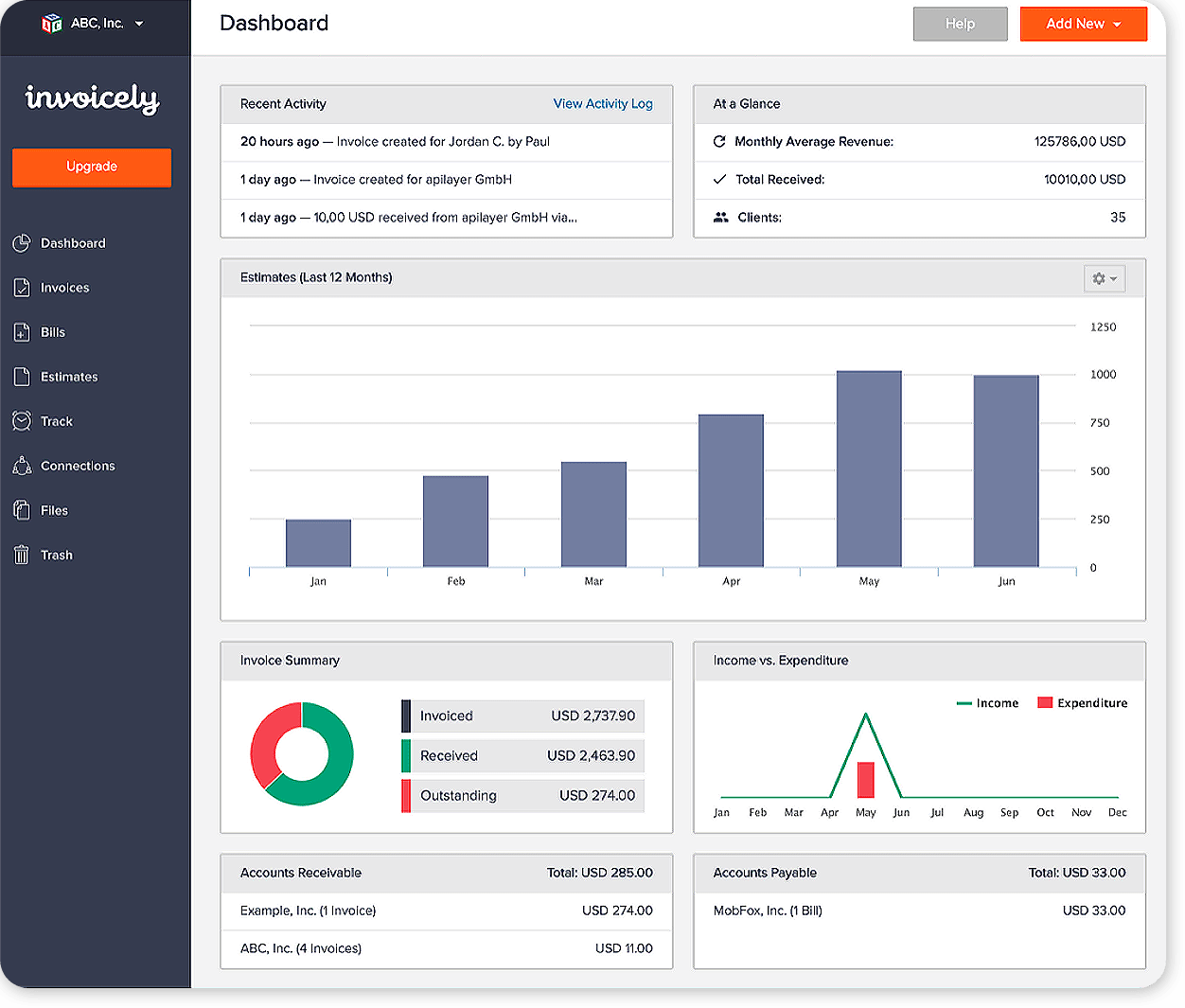

#20 – Invoicely

In a hurry? Invoicely’s quick and easy interface lets users create and send invoices, estimates, and bills in just 60 seconds.

It also doubles as entry-level cloud accounting software, letting you create reports, review yearly statements, and track receivables and payables so you have a clear idea of your cash flow and performance. Invoicely is a newer online invoice app, though it’s easy to customize and great for small businesses starting out with expense tracking.

Top Features

- Enter your branding and set up product or line item templates

- Send out payment requests and reminders in no time

Trial and Pricing

How to choose the best billing software for your business

With so many options to choose, from how do you decide?

Different companies need different features, so you can ask yourself a few questions relating to your core business goals to help separate your options and find the right invoicing software for your company.

Growth

- How easy it is to scale over time?

- Are different pricing tiers based on several accounts or transactions?

- Can you add bank integrations, payment methods, or new templates over time?

Hidden Fees

- What are all of the hard costs involved?

- What is covered by the monthly subscription, and what isn’t?

- Are there extra fees for integrating with other systems or adding users?

- Do you get charged transaction fees for credit card processing, and how close are they to those from other providers?

Usability

- How straightforward is the setup?

- Are you struggling just to make it through the free trial?

- What training and support do they include?

- Who else will need to use this at your company?

Are you ready to simplify your business accounting?

Software solutions should simplify your operations, not complicate them.

The right invoicing software will meet your branding, communication, and growth needs as well as your budget. And as you are able to more accurately track your positive cash flow, you can make better business decisions for yourself.

See how many customers haven’t settled their invoices (and chase them down with late fees if needed). Create recurring plans with your regulars and consider upgrading your available payment methods. You can even decide to increase or adjust your rates so what you bill clients reflects your worth and covers your expenses accordingly.

In the end, the best billing software is the one you can use consistently, without frustration, and without breaking the bank.

Once you have a system up and running, you’ll have more time available to focus on other business & marketing strategies and your clients…and maybe even some newfound income to reinvest into your business.

Interested in more small business management tips to help your trade company succeed? Subscribe to our newsletter for updates on new content, tips, and more!